flow through entity private equity

Most governmental plans take the position that as governmental entities. Raising a private equity fund requires two groups of people.

Stock Talk New Brand Names For The New Decade 2020 30 Movie Market Brand Names Jet Airways

Blocker corporation to hold an investment in a US.

. Indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below. Ad Explore Alternative Investments With Insights and Guidance From the Private Bank Team. It is typical in private equity funds for certain tax-sensitive investors including US.

The pass-through entity helps the owners of the business to pass their income to them. A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible economics a control vehicle and the ability to grant profits interests as a compensation incentive discussed below. The baseline structure would involve the private equity buyer acquiring both the flow-through and blocked portions of the investments under a single aggregating vehicle taxed as a.

A purchaser will still obtain a basis step-up in the context of the purchase of 100 of the entity equity interests. We dont know how the new tables are going to look but based on the current tables a 25 rate would be favorable at single income of 91901 and married joint of 153101 but it. Real Estate Capital Markets REITs.

With flow-through entities such as. Flow-through portfolio company as the court decision may permit the non-US. There is an increasing amount of public investment in private equity funds.

1 Financial Sponsor Sponsor in image. Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes.

In this legal entity income flows through to the owners of the entity or investors as the case may be. 2 LPs and LLCs are pass-through entities for federal income tax purposes. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals.

Owners have to pay takes on their dividend income and also on the. Structuring Newco as Flow-Through Entity 301 NEWCO AS S CORP 34 3011 Limited Liability and General Characteristics 34 30111 General 34. Taxes and file US.

An entity taxed as a flow-through will generally have greater value because of the significant tax benefits and that can be afforded the purchaser than for. A pass-through entity is a business structure in which the taxes on the generated business revenue are directly passed on to the owners to avoid double taxation. Through this arrangement business owners and shareholders only pay taxes on their personal income generated through this business and dont have to pay additional corporate taxes for running the company.

The most significant benefit of using this mechanism is that the businessman can easily save on their taxes. PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner. 01 April 2021.

For example in 2006 the private equity firms KKR and Apollo Management raised funds through the Amsterdam Stock Exchange in the amounts of US5 billion about EUR38 billion and. The team of individuals that will identify execute and manage investments in privately-held operating businesses. Blocker corporation rather than a US.

Investors such as sovereign wealth funds to own their indirect interests in certain types of fund investments through an entity taxable as a US. 1057 Formation of Private Equity Venture Capital or Buyout Fund 113 106 HISTORY OF PRIVATE EQUITYVENTURE CAPITAL INVESTING 113. Corporation a so-called Blocker which insulates such investors from the direct obligation to pay US.

Some of the most active investors in private equity funds are governmental pension plans such as those for states or municipalities. Private equity firms are on a buying spree as they seek to accelerate portfolio company growth amid a relatively slow-growing economy. One reason for such restrictions is a funds need to avoid.

This is generally comprised of a General Partner and a Management Company. Venture capital funds and private equity funds typically contain significant limitations on the ability of investors to transfer their partnership interests. The double taxation can be avoided using this mechanism.

Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current business and compare whether a flow-through partnership or S corporation S corp structure is still the right approach to meeting your business goals. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. Tax exempts and non-US.

Hence the income of the entity. Planning devices can include the following. Generally investors in qualified affordable housing project investments expect to receive a majority of their return through the receipt of tax credits and other tax benefits.

Investments in qualified affordable housing projects through flow-through limited liability entities have different risks and rewards than traditional equity investments. Or other flow-through entity is attributable to the flow-through entitys interest direct or indirect in. Blocker to exit its investment in the US.

Model Portfolio Subscription Model Portfolio Investing Cash Flow Statement

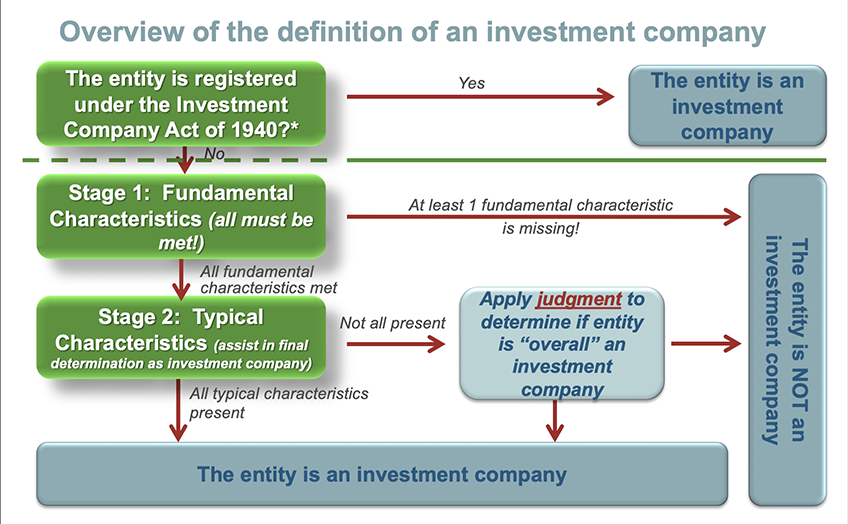

Accounting For Investment Companies Under Asc 946 An Overview Gaap Dynamics

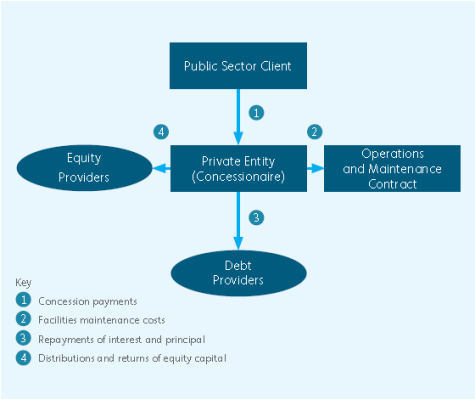

What Are Public Private Partnerships

Simple Steps Of Company Registration In India Startup Growth Unique Business Ideas Business Structure

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

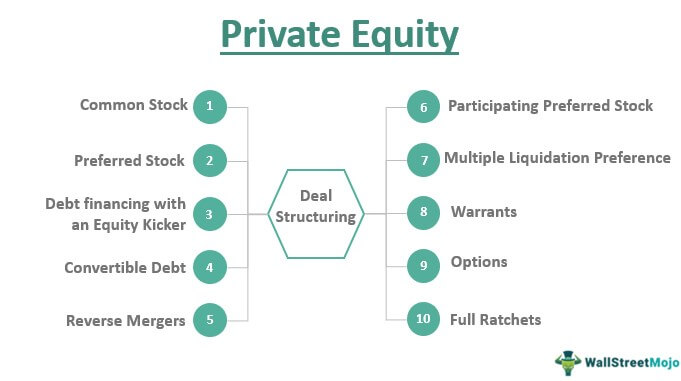

Private Equity Meaning Investments Structure Explanation

Building Risk Assessment Checklist Assessment Assessment Checklist Risk Analysis

Document Required For Private Limited Company Registration Private Limited Company Limited Company Startup Company

Suppose You Are Confused To Arrange Auditor Resume It Is Better For You To Pick The Commonly Accepted Resume Format Y Accountant Resume Manager Resume Resume

Register Your One Person Company Registration In Kolkata Sole Proprietorship Public Limited Company Company

Pin On Journal Spreads And Notes

How To Start A Poultry Farm In Uae Poultry Farm Poultry Farm

Private Equity Fund Structure A Simple Model

What Is A Private Equity Waterfall The Preferred Method Of Equity Funding

Choosing A Legal Entity For Real Estate Investing Morris Invest Real Estate Investing Real Estate Investing Rental Property Real Estate Marketing

Pass Through Entity Definition Examples Advantages Disadvantages

Model Portfolio Subscription Model Portfolio Investing Cash Flow Statement

Pass Through Entity Definition Examples Advantages Disadvantages